Frequently Asked Questions

General FAQs

Is my money insured?

Yes, your money is safe with us and insured by the NCUA up to $250,000 per member-owned account.

- How Your Accounts Are Federally Insured (PDF/English)

- How Your Accounts Are Federally Insured (PDF/Spanish)

How can I set up direct deposit?

To set up direct deposit, please contact your employer's payroll department. You will need to provide them with the routing number 261171309 and your 13-digit account number, which can be located in Online Banking or the Georgia United Mobile App.

Where can I find my account number?

You can locate your 13-digit account number securely in Online Banking or the Georgia United Mobile App. Once logged in, click the account (ex. Unified Checking) and on the account details screen you can view your account number.

What’s Georgia United’s routing number?

Georgia United's routing number is 261171309.

How can I apply for a new loan or refinance my existing loan?

To quickest way to apply for a new loan or refinance your existing loan is to complete our online loan application. Applications can also be completed by calling 888.493.4328 or scheduling an appointment at a branch location.

If I want to become a member, what is the best way to open an account?

You can apply for membership by completing our online application.

To open an account for someone under the age of 18, please visit a branch or call us at 888.493.4328. Note that a joint owner must be on the account for children and teens.

What if I have an appointment but need to cancel or am running late?

If you need to cancel or reschedule an appointment time, please click the link located below your confirmation number in your confirmation email. If you are more than 15 minutes late to your scheduled appointment, Georgia United may need to cancel your appointment.

If my branch is temporarily closed, how can I take care of my banking needs?

There are several ways to get your banking done, based on what’s most convenient for you:

- Bank online. Manage your entire relationship online when you enroll in Online Banking. You'll be able to check your balance, pay bills and transfer funds from your home. See what else you can do with Online Banking.

- Bank on mobile. Get the convenience of Online Banking on your mobile device—plus you can deposit checks* in a snap. Download the Georgia United Mobile App ( Android and iOS) to get started. See what else you can do with Mobile Banking.

- Bank at the ATM. Check your balance, deposit cash or checks or make a withdrawal at our network of over 100,000 surcharge-free ATMs. Find one near you.

- Find a nearby branch. Check our website for branch availability to see if there's another branch nearby.

*Items transmitted using this service are not subject to the funds availability requirements of the Federal Reserve Board Regulation CC. Mobile check deposits are subject to verification and may not be available for immediate withdrawal.

How do I reorder checks?

You can securely reorder checks in Online Banking. Once you log in, click on the account you want to order checks for and select the ‘Reorder Checks’ button. Check reorders may also be placed by calling our Member Care Center at 888.493.4328, at any of our branch locations or by calling 800.Deluxe1.

If this is your first-time ordering checks, you will need to call 888.493.4328 or visit a branch location to place your order.

Additional FAQs

Account Alerts

How do I set up or customize my notifications?

You can set up alerts in your Online Banking account. On the menu, go to 'Services' and click 'Alerts'.

You can choose which alerts you want to receive and how you'd like these delivered. Alerts can be sent via text, email or push notification directly to your mobile device.

How do I remove alerts?

To turn off alerts, log into your Online Banking account. On the menu, go to 'Services' and click 'Alerts'. Select the alert you wish to discontinue and toggle the switch off to stop receiving alerts.

You may choose to switch off account alerts at any time. However, security alerts are enabled for your account protection and cannot be disabled.

How do I update my email address for notifications?

You can update your email address in Online Banking by:

- Selecting 'Services' from the main menu

- Click on 'Member Information'

- Update your email address

- Click 'Save'

Can I receive alerts if I don’t have an Online Banking account?

Account alerts are only available if you have a Georgia United Online Banking account. If you don't have an account, you can enroll anytime.

Cards

Can I do a cash advance with my Visa card?

If you have a Georgia United Cash Back Visa Signature® Card or Platinum Visa® Credit Card and need quick access to cash, you can request a cash advance at any of our branch locations or in Online Banking. To request a cash advance through Online Banking, you will follow the same steps you use for making a transfer. Navigate to the 'Transfer' menu, choose your credit card from the 'From' dropdown list, and then select the account into which you wish to transfer the funds. Please note, a fee of 2.00% applies to each cash advance over $2.00. Please see our Credit Card Terms & Conditions for more information.

How do I activate my Georgia United Debit or Credit Card?

How do I dispute a transaction on my account?

You can dispute a transaction in Online Banking anytime following these simple steps. Disputes can also be filed at a branch or by calling 888.493.4328.

Can I make touch-free payments using my card?

How do I request a balance transfer?

How can I set up alerts for my card?

You can set up alert notifications in Online Banking. On the menu, select ‘Services‘ and click ‘Alerts’. To set up a new alert, select your delivery preference (email, text or push notification) and toggle the alert on. There are several different alert types you can set up:

- General alerts

- Share alerts

- Loan alerts

- Security alerts

What are some useful alerts for my cards?

How do I order a replacement card?

If your card is worn and needs to be replaced before expiration, you can order the same card in Online Banking by following these steps:

- Login to Online Banking

- Click 'Services' in the navigation menu

- Select 'Manage Cards'

- Select the card you would like to replace

- Then choose 'Request Replacement Card'

Please note, replacement cards are issued with the same card number so this option is not recommended for lost/stolen cards.

How do I report a lost/stolen card?

If your card is lost/stolen or you suspect fraud, you can quickly freeze your card in Online Banking. To order a new card with a new card number, we'll be happy to assist you. Please call our Member Care Center at 888.493.4328 or stop by a branch location.

How to do I freeze my card?

If you've misplaced your card, quickly freeze it in Online Banking any time of day, or you can contact our Member Care Center at 888.493.4328 during business hours. To freeze your card online:

- Log in to Online Banking or the Georgia United Mobile App

- Click 'Services' in the navigation menu

- Select 'Manage Cards'

- Select the card you would like to freeze and choose 'Freeze Card'

Once your card is found, you can unfreeze it following these same steps.

Courtesy Pay

How do I opt-out of Courtesy Pay?

You can opt-out of Courtesy Pay at any time by completing one of the following:

- Contact our Member Care Center at 888.493.4328

- Visit one of our branch locations

- Complete the Standard Overdraft Protection form and mail it to Georgia United Credit Union, Attn: Deposit Services, PO Box 100070, Duluth, GA 30096

Are there any circumstances when an overdraft item won’t be paid?

How will I be notified that Courtesy Pay was used?

If I use Courtesy Pay, when do I need to bring my account current?

Is there a fee to opt-in for Debit/ATM coverage?

I already have Overdraft Protection. What’s the difference?

What if I don’t plan to use Courtesy Pay?

Is there a cost to use Courtesy Pay?

E-Statements

How do I update my email address for notifications?

You can update your email address in Online Banking by:

- Selecting 'Services' from the main menu

- Click on 'Member Information'

- Update your email address

- Click 'Save'

How long are E-Statements available?

How am I notified when an E-Statement is available?

Mobile Deposit

How do I endorse a check for Mobile Deposit?

To deposit a check for Mobile Deposit, you must write "For Mobile Deposit at Georgia United" along with your signature on the back of the check. Checks submitted without both of these items may be delayed or returned.

Is there a limit on how much money I can deposit using the Georgia United Mobile App?

When will my money be available?

Deposits accepted using the Mobile Deposit service will be available within two business days. Business days are Monday – Friday, excluding federal holidays.

If we have reason to doubt the collectability of the check submitted, we may delay the availability of funds for a reasonable period. In such cases, we will notify you of this action.

What should I do with my check after I deposit it?

We recommend that you mark your check as submitted and retain your check for 10 days after the deposit is posted to your account.

Person-to-Person Pay

When will my account be debited?

If the recipient selects to receive funds via debit card or to a Georgia United account, your account will be debited at the time they submit their information. If recipient chooses to receive funds directly to their external account and submit their information before 5 pm ET, your account will be debited the same day. If the recipient submits their information after 5 pm ET, your account will be debited on the next business day. If the recipient is receiving funds to a Georgia United account, the account will be debited immediately.

Who can I send money to?

You can send money to anyone in the United States with a checking or savings account at any bank or credit union or another Georgia United member.

When will the recipient receive the funds?

The recipient will receive funds immediately if they choose debit card or a Georgia United account as their delivery method. Recipients who submit their external account information and routing number before 5 pm ET can expect deposits the next day. If they submit their information after 5 pm ET, the funds will be deposited the second business day after the payment is accepted.

What information does the recipient need to provide?

- To receive funds by debit card, the recipient will need to provide their debit card number and expiration date.

- To receive funds directly to their external account, the recipient will need to provide their checking or savings account number and routing number.

- If the recipient is another Georgia United member, they will only need to provide their member number, share ID and account type (checking or savings).

A security question will need to be answered the first time the recipient receives funds via debit card or external account or if the security question is updated.

What if the recipient doesn’t answer the security question correctly?

If the recipient does not respond correctly after three attempts, the process of sending funds will not begin and the transaction will be canceled. You will be alerted by your preference of email or text if this occurs.

Do I have to create a security question every time?

Once the recipient has answered the security question correctly and entered their information to claim funds, they are no longer required to answer a security question for future payments – unless you change the question and/or answer.

Is there a cost to use this service?

There is no fee to use the service. Overdraft/returned item fees may apply, see Share Rates and Fees Schedule for additional fees that may apply.

What if my recipient doesn't accept the payment?

Payment will be canceled if the recipient does not claim funds within seven calendar days.

What debit networks accept Georgia United P2P?

Georgia United P2P is accepted by many debit networks including Accel, CULIANCE (formerly CU24), NYCE, Plus, Shazam and Star. To confirm a debit card can accept the funds sent, check the back of your card for one of these network logos.

Shred Events

Does Georgia United provide paper shredding events?

Effective January 1, 2022, Georgia United will no longer offer free paper shredding events. Although we have hosted these events for many years, the rising costs and scheduling challenges during the pandemic have caused us to discontinue this service.

If shredding events are no longer available, what are other ways to protect my personal information?

The best way to reduce the risk of identity theft or your information falling into the wrong hands is to go paperless and enroll in E-Statements. This free service allows you to receive your member statements securely in Online Banking.

Where can I find other shred events in my area?

We encourage you to google “free shred events” or contact your county’s waste management service for similar services in your area.

Skip-A-Pay

What if I’ve used all the Skip-A-Pay requests allowed?

If you've already completed two skips this calendar year, you won't be eligible to skip another payment until next year.

If I have automatic payments set up, will I need to cancel these?

Is there a fee?

Yes, a $40 fee is charged each time a payment is skipped.

How often can I skip my payment?

You may complete two skips per calendar year.

Transfers & Payments

If a deposit is made by electronic transfer and is returned due to non-sufficient funds, will Georgia United automatically attempt to collect funds until paid?

What if the funds are unavailable to cover my transfer?

You are obligated to have sufficient funds in your account to fund a transaction. If the funds are not available in your account, you may be charged an NSF fee by Georgia United or your other financial institution.

See Share Rates and Fees Schedule for additional information.

Is there a fee to make a transfer to another financial institution?

What if the payment date falls on a holiday?

How much notice is needed to cancel a transaction?

How do I cancel my transaction request?

Are there dollar limits on transfers from my external accounts through ACH?

How are funds transferred to another financial institution?

What if I provided incorrect account information for the external financial institution?

You will need to contact the other financial institution to verify and confirm the information required for completing the transfer request. You will then need to update the information in the external transfers section of Online Banking.

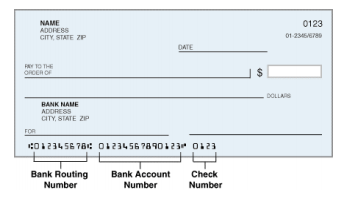

What information will I need to provide about the external account?

- The account name

- The 9-digit routing number of the financial institution

- Account number

- The account type. Funds can only be transferred to/from a savings or checking account.

Image below: reference where to find your 9-digit routing number and your account number.

How do I setup an external transfer in Online Banking?

For step-by-step transfer instructions, view our Online Banking user guide.